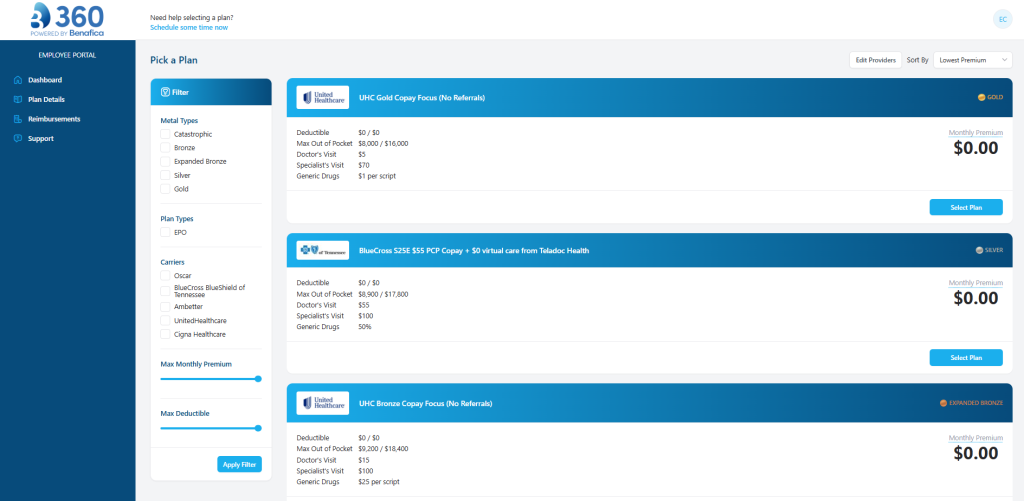

When you’re ready to compare health plans in BEN360, the filter tools make it easy to narrow down options and find the coverage that fits your needs. Instead of scrolling through every available plan, you can quickly sort and filter by the things that matter most to you — such as metal tier, network type, carrier, and your preferred premium or deductible range.

Filter by Metal Tier

Metal tiers help you quickly compare plans based on how costs are shared between you and the insurance carrier. Using this filter lets you narrow your options by the level of coverage and out-of-pocket expectations you prefer.

- Catastrophic: Lowest premiums with very high deductibles; available only to certain individuals (under 30 or with a hardship exemption).

- Bronze: Lower premiums, higher out-of-pocket costs.

- Expanded Bronze: Similar to Bronze but may include slightly richer benefits or lower deductibles depending on the plan.

- Silver: Balanced premiums and cost-sharing; many people find these the “middle ground” option.

- Gold: Higher monthly premiums, lower out-of-pocket costs when you need care.

Filter by Plan Network Type

Health plans come in different network types, which determine how you access doctors, specialists, and hospitals. Using this filter helps you find plans that match how you prefer to receive care.

- HMO (Health Maintenance Organization): Lower costs, but requires you to stay in-network and often get referrals before seeing specialists.

- EPO (Exclusive Provider Organization): No referrals needed, but coverage is typically limited to in-network providers only.

- PPO (Preferred Provider Organization): More flexibility — coverage available both in- and out-of-network, usually at a higher premium.

- POS (Point of Service): A hybrid of HMO and PPO—requires a primary care provider and referrals, but offers some out-of-network coverage.

Filter by Carrier

The carrier is the insurance company that provides your health plan. If you’ve had a good experience with a specific carrier in the past — or you simply prefer to review plans from companies you trust — you can use the Carrier filter to narrow your options.

Selecting one or more carriers will show you only the plans offered by those insurers, making it easier to compare coverage from familiar providers and choose a plan from that specific company.

Filter by Premium

The Premium filter lets you set a minimum and maximum monthly amount so you see only the plans that fit within your budget — especially helpful if you want to stay close to the allowance your employer is offering through your ICHRA.

By adjusting the premium range, you can easily narrow your options to plans that match what you’re comfortable paying each month.

Filter by Deductible

Similarly, the Deductible filter lets you set a minimum and maximum deductible amount to narrow your search to plans that match your comfort level for out-of-pocket costs.

If you prefer lower upfront costs when you need care — or you’re comparing how deductible levels impact your total spending — you can adjust this filter to quickly find plans that best fit your financial and coverage preferences.